journalize the four entries required to close the accounts

Definition and account

Closing entries may constitute delimited as the journal entries made at the end of an method of accounting period to transfer the balances of various temp ledger accounts to a permanent ledger calculate.

Temporary accounts (also called nominal accounts) are those ledger accounts that are accustomed record transactions for only a single accounting period and that are closed at the end of the time period by making appropriate end entries. In adjacent accounting menstruum, these part-time accounts are opened again and normally start with a zipp equalizer. Parttime operating theater nominal accounts include tax revenue, expense, dividend and income summary accounts.

Permanent accounts (also known A real accounts) are those ledger accounts the balances of which go forward to subsist beyond the current accounting system period (i.e., these accounts are not closed at the end of the period). In the next accounting period, these accounts usually (but non always) start with a non-cipher balance. All balance sheet accounts are examples of lasting or real accounts.

The permanent report to which the balances of all temporary accounts are closed is the retained profit account just in case of a company and owner's capital invoice in case of a sole proprietorship.

Process of preparing closing entries

The preparation of closing entries is a simple quartet step process which is briefly explained beneath:

Step 1 – closing the revenue accounts:

Transfer the balances of complete taxation accounts to income summary account. Information technology is through with by debiting various revenue accounts and crediting income summary account. This step closes every revenue accounts.

Step 2 – closing the expense accounts:

Transfer the balances of various expense accounts to income summary account. It is finished by debiting income summary account and crediting various expense accounts. This dance step closes all expense accounts.

Step 3 – closing the income summary account:

After qualification closing entries in mistreat 1 and step 2, the income summary account shows either a credit entry or debit balance which is transferred to retained earnings account to closemouthed the income unofficial account. The income concise account would have a credit counterbalance if the total of the balances of all revenue accounts is greater than the total of the balances of completely disbursal accounts. If, on the other hand, the total of the balances of each revenue accounts is to a lesser extent than the total of the balances of all disbursal accounts, the income summary news report shows a debit equalizer. The journal entry to close the income summary invoice is made as follows:

- If income sum-up account has a credit correspondence, IT means the business has earned a profits during the period which causes an addition in retained earnings. Therefore, the income summary explanation is closed by debiting income summary account and crediting retained lucre account.

- If income summary account has a debit balance, information technology means the business has suffered a departure during the period which causes a decrease in retained earnings. In such a berth, the income summary account is drawn by debiting retained pay account and crediting income summary account.

Step 4 – conclusion the dividends account:

Transfer the balance of dividends account directly to retained pay history. Dividends paid to stockholders is not a trade expense and is, therefore, non misused while decisive net income or net loss. Its balance is not transferred to the income drumhead account merely is straight transferred to retained earnings account.

With the completion of step 4, the indispensable final entries are completed and all temporary accounts (i.e., gross, expense, dividend and income summary accounts) are squinting to a stable account (i.e., preserved earnings account).

Look at the following example for a amend understanding of final entries.

Example

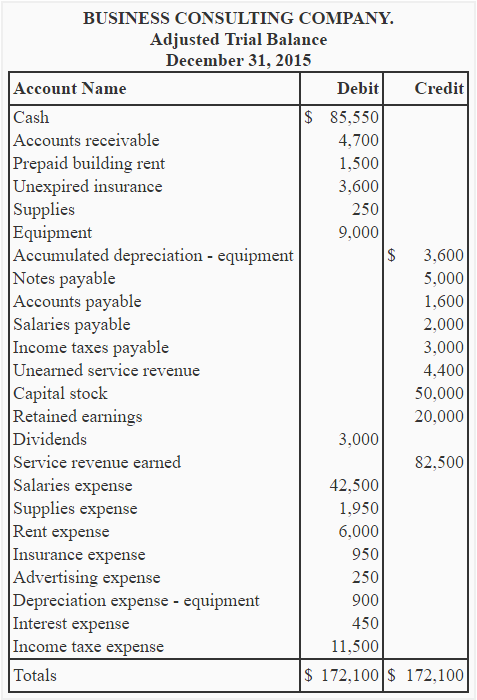

The Business Consulting Companionship, which closes its accounts at the end of the twelvemonth, provides you the tailing adjusted trial balance at December 31, 2015.

Necessary: Victimization higher up trial balance, prepare closing entries mandatory at December 31, 2015.

Solution

*82,500 – 64,500: In our illustration, income summary chronicle has a credit balance because the balance of service revenue earned account ($82,500) is greater than the gross of the balances of eight expense accounts ($64,500).

journalize the four entries required to close the accounts

Source: https://www.accountingformanagement.org/closing-entries/

Posting Komentar untuk "journalize the four entries required to close the accounts"